Category: Law

-

The Church’s Messages to the Supreme Court

An amicus brief is a document submitted to courts by groups or people who have some interest in the outcome of the case. For landmark Supreme Court cases a lot of professional organizations, for example, will take a position and outline their reasons. My understanding is that the justices and their clerks don’t actually…

-

The Church in the Courts, 2024

The website “Court Listener” is a publicly available source for looking up cases around the country. By searching for the term “Latter-day” I looked for all cases involving the Church that were filed sometime during 2024. Of course, I am no lawyer (unlike By Common Consent, our bench is quite shallow on the legal side…

-

Voir dire

Voir dire, from Norman French, is pronounced “jury selection” by normal people, but I had always stayed one step ahead of the law and never seen it first hand.

-

The Misguided Quest for a Common Moral Framework

The Mormon Newsroom just posted a new think-y piece titled “The Quest for a Common Moral Framework.” A few years back the Newsroom posted a number of these reflective essays, such as “Approaching Mormon Doctrine“, but not so much recently. So this one is worth taking a look at. It seems like a spinoff from…

-

20th Century LDS Thought on Sexual Assault: Some Context

The Salt Lake Tribune recently published an article called “How outdated Mormon teachings may be aiding and abetting ‘rape culture.’” While I am also concerned about ways in which Mormon culture may encourage rape culture (see here and here and here), I want to push back against one portion of the article.

-

Mormonism at the Scopes Trial

I read Edward J. Larson’s Summer for the Gods: The Scopes Trial and America’s Continuing Debate Over Science and Religion (Harvard Univ. Press, 1997) earlier this month, and was surprised to see the Book of Mormon appear in one of Clarence Darrow’s arguments to the court. Funny how little mention there is of the Scopes…

-

Same-Sex Marriage Bans and Tax

The District of Utah has had a busy week. As I’m sure you heard (and if you haven’t, you ought to read Kaimi’s post first), Utah’s ban on same-sex marriage has been struck down as unconstitutional. A week ago, in the wake of the decision that didn’t actually legalize polygamy, I looked at the potential…

-

Gay Polygamy in Utah!

By now you’ve heard the news. A federal judge in Utah just ruled that the state’s ban on same-sex marriage was unconstitutional. This follow on last week’s ruling, from a different judge, that portions of Utah’s polygamy statute were also unconstitutional. What does it mean? Obviously, it means the advent of gay polygamy!! It won’t…

-

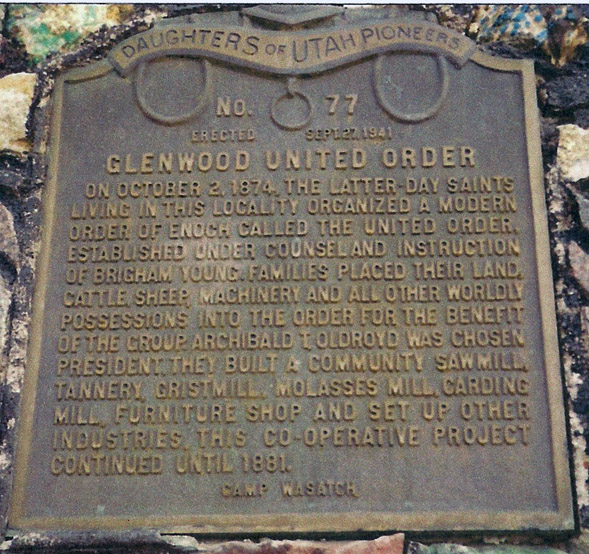

Decriminalizing Polygamy (and, of Course, Tax)

On Friday, December 13, the Judge Waddoups, a district court judge in the District of Utah, held that Utah’s criminalization of polygamy was unconstitutional. Partly, anyway. More on that in a minute. I suspect that this opinion will reverberate throughout the blogosphere and the mainstream media, with the reporting displaying various levels of accuracy. The…

-

Happy(?) Repeal Day!

The Twitters tell me that 80 years ago today, Utah became the 36th state to ratify the 21st Amendment, thus ending Prohibition. Whatever you think about Prohibition, it’s probably worth noting the Pres. Grant was not a fan of its end. In fact, he addressed the end of Prohibition—and Utah’s role in ending it—at General…

-

Money for Nothing and the Housing for Free

On Thursday, November 21, the district court of the Western District of Wisconsin declared (part of) the parsonage exemption—a special tax provision for certain religious persons—unconstitutional.

-

Invite the IRS to Your Family Reunion

Over at Keepaptichinin, Amy Tanner Theriot has a wonderful post talking about family associations, and providing some guidelines for how to put together a successful association. In the post, she mentions that family associations can qualify as 501(c)(3) tax-exempt entities. At the mention of Code sections (and revenue rulings!), my ears perk up, and I…

-

An Overview of LDS Involvement in the Proposition 8 Campaign

I’ve just posted my article, ‘The Divine Institution of Marriage’: An Overview of LDS Involvement in the Proposition 8 Campaign, to SSRN. The article is largely descriptive, setting out in some detail the church’s actions and statements relating to Proposition 8. It chronicles a significant amount of factual material that has not been discussed at…

-

Moroni Torgan, Yeah Samaké, and Political Neutrality

As a result of its political neutrality policy, the Church is not going to endorse Mitt Romney in his bid to become President (or, for that matter, Harry Reid in his bid to be reelected to the Senate). There are probably a number of reasons for the Church’s desire to avoid endorsing a candidate but,…

-

Polygamy 2012

Once upon a time, family law was a marginal legal topic that didn’t make many headlines the way constitutional law or criminal law so often do. But gay marriage and Prop 8 have propelled family law and marriage to the legal center stage. In an odd parallel development, “the family” has, over the last few…

-

Taxing(?) City Creek Reserve, Inc.

The other day, Nate responded to many of Jana Riess’s criticisms of the City Creek mall in Salt Lake. As I read her piece, one sentence jumped out at me.

-

Mitt Romney’s Tithing Problem (?)

ABC broke the news: Mitt Romney has donated millions of dollars worth of stock to the Mormon church. SEC filings disclose that a Bain partner donated $1.9 million of Burger King stock to the Church; in addition, the Church has received stock of other Bain holdings, including Domino’s, DDi, Innophos, and the parent company of…

-

How Are You Celebrating?

No, today isn’t a national holiday. It’s not any particular religious festival. We’re more than a week away from Halloween, a month from Thanksgiving, and a couple months from Christmas. The only reason you have today off (assuming you have today off) is because today is Saturday. And yet . . . On October 22,…

-

Background: Elder Oaks and the Charitable Deduction

Yesterday, as Marc pointed out, Elder Oaks testified in front of the Senate Finance Committee in favor of the deduction for charitable giving. He argued that the charitable deduction is vital to the nation’s welfare. Why, though, these hearings on the charitable deduction? Is it under attack? In case you haven’t been following the politics…

-

Elder Oaks Testifying Before Congress Today

For those interested, Elder Dallin H. Oaks is testifying right now before the Senate Finance Committee on tax reform, specifically incentives for charitable giving. He is testifying at the request of Senator Hatch.

-

Free Your Pulpit

On Sunday, as we luxuriated in General Conference (however we followed it), we missed an annual tradition: Pulpit Freedom Sunday.[fn1] A quick background on Pulpit Freedom Sunday: on July 2, 1954, Lyndon Johnson proposed that Section 501(c)(3) (the Internal Revenue Code section that exempts, among other things, churches, universities, and the NCAA from tax) be…

-

Mission Finances, part 3

(Note: this is the fourth part of a several-part series. You can read previous installments here, here, and here.) Quick review: prior to November 1990, missionaries and their families paid the actual cost of their missions. Moreover, parents would send money directly to their sons and daughters, with no intermediation from the Church. In May…